Imagine if a single number could quietly influence many of your financial decisions… that’s exactly what happens when you know your credit score for free. For many people, the CIBIL score only comes into focus when a loan or credit card application is on the horizon. Until then, it remains an abstract concept. However, knowing your score early offers clarity, not pressure. It helps you understand how your past credit behaviour appears to lenders and what you can do next.

When you know cibil score for free, you gain visibility into patterns that may otherwise go unnoticed—timely repayments, credit usage, or recent enquiries. This awareness allows you to plan rather than respond at the last minute. Think of it this way… when you already know where you stand, every financial decision feels more measured and far less uncertain.

What Your CIBIL Score Actually Represents

A CIBIL score is a numerical summary of your credit history. It reflects how you have handled credit over time, including loans, credit cards, and repayment habits. While the score itself is important, the factors behind it matter just as much.

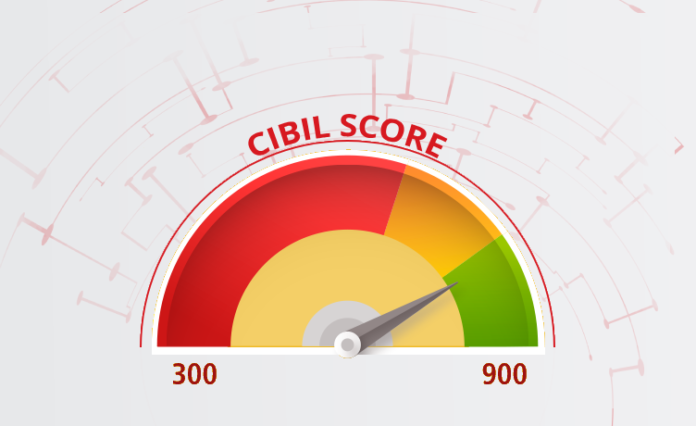

When you check cibil score, you are essentially reviewing a record of your borrowing behaviour. Some people also like to study how lenders interpret this information by understanding the credit score range, which provides context to the number they see. This combination—knowing the score and understanding its range—offers a clearer picture than a number alone.

Understanding the CIBIL Score Range

Knowing where your score falls within the CIBIL score range helps you interpret what it means in practical terms. Scores typically fall into broad bands that indicate varying levels of credit readiness.

Here is a simple way to understand it:

| Score Band | What It Generally Indicates |

|---|---|

| Lower range | Limited or inconsistent credit history |

| Mid range | Moderate credit behaviour |

| Higher range | Strong and consistent credit behaviour |

This perspective helps you move beyond worry or guesswork. Think about it like this… the range is a guide, not a verdict. Scores can and do change over time.

Why You Should Check CIBIL Score Regularly

Many people check their credit score once and forget about it. In reality, regular checks help you stay informed and prepared.

Common reasons to review your score include:

- Planning future borrowing or refinancing

- Tracking progress after trying to increase the credit score

- Identifying errors or outdated information

- Understanding the impact of recent financial decisions

When you know cibil score for free at regular intervals, you develop a habit of awareness rather than urgency.

How Knowing Your Score Helps You Increase Your CIBIL Score

If you aim to increase your credit score, awareness is the starting point. You cannot improve what you do not track. Once you know your score, you can focus on habits that support gradual improvement.

These may include timely repayments (especially for EMIs/credit cards), balanced credit usage, or limiting frequent loan enquiries. Think of it this way… improvement is usually the result of consistency, not sudden changes. Over time, these patterns begin to reflect positively on your score.

Simple Tools That Help You Know Your CIBIL Score Free

Today, digital platforms make it easy to know your credit score for free with minimal effort. Most authorised platforms provide instant access along with a summary of factors influencing the score.

Here’s how different approaches support awareness:

| Method | What It Offers | How It Helps |

|---|---|---|

| Online score check | Instant access | Quick clarity |

| Detailed report | Factor-wise breakdown | Deeper understanding |

| Periodic monitoring | Trend visibility | Supports improvement |

Using these tools responsibly allows you to stay informed without overanalysing every fluctuation.

Common Myths Around CIBIL Scores

One common belief is that checking your score frequently reduces it. When you know cibil score for free through authorised checks, your score remains unaffected. Another misconception is that a single missed payment defines your credit profile forever. In reality, recent behaviour carries more weight than older events.

Think of it this way… your CIBIL score is a moving reflection, not a permanent label.

Making Credit Awareness Part of Your Routine

Instead of treating credit checks as a one-time task, consider making them part of your regular financial routine. Just as you review bank statements or track expenses, reviewing your credit score helps you stay aligned with long-term plans.

When you check your CIBIL score periodically, understand the CIBIL score range, and take steps to increase your CIBIL score where needed, you remain in control rather than reactive.

Summary – Why It Pays to Know CIBIL Score Free

To know your CIBIL score for free is to stay informed, prepared, and confident. Whether you are checking your score for the first time or monitoring progress over time, awareness is the foundation of better financial decisions.

Think of it this way… knowing your CIBIL score does not create pressure. It creates perspective. With regular checks, realistic expectations, and steady habits, credit awareness becomes a quiet advantage—supporting your plans today and preparing you for opportunities tomorrow.